As someone who was born in 1988, I’ve lived through some pretty wacky economic disruptions. But I think that the mood now prevailing in the global business environment may make the current era about as weird as things have ever been, with no two people seeming to agree on whether boom or bust are just around the corner.

Beyond that general context, there are all these little threads that have been popping up, which appear to at least give hints as to what themes will be the dominant catalysts for economic growth in the years ahead. In addition to AI and automation, one of the most recurrent themes is defense, and the combination of these two categories essentially sets the tone for everything else that feels important concerning the global economic future.

Startups vs. established players, emerging technologies vs. legacy processes, Big Tech collaborating with the government, a scramble to reshore manufacturing supply chains, international competition for resources and talent — these are the key variables at play in a digitization arms race that’s rapidly reshaping the planet’s business landscape. Against that backdrop, it’s not so surprising that, despite its rather small footprint, the additive manufacturing (AM) industry is right in the midst of where all the action is happening.

Which companies most closely reflect that overall state of affairs? One of the answers that immediately comes to mind may surprise you: Velo3D, the original equipment manufacturer (OEM) of metal powder bed fusion (PBF) systems based in Silicon Valley.

For a while there, Velo3D had a rough go of it. The company was right on the brink of potential bankruptcy at the end of 2024, having entered into a Forbearance Agreement with its creditors. With the departure at the end of 2023 of founder and longtime CEO Benny Buller (who remained on the board until December 2024), constantly shuffling personnel, and a delisting from the New York Stock Exchange (NYSE), the company, at least on the surface, appeared rudderless and out of steam.

Yet even prior to the company’s rescue via an investment by Arrayed Additive, barely a couple of weeks after entering forbearance, there had already been signs that Velo3D was working towards a turnaround. The company’s decision to buckle down and focus on defense, for instance, started at the end of 2023, and Velo3D landed a key defense-related contract around that time, with Bechtel Plant Machinery Inc. (BPMI). This contract involved supplying a Sapphire XC printer to a Florida AM facility, built by BPMI for ATI.

But, to make an analogy, you can’t build an expansion on your house when the foundation is in desperate need of repair. The company’s financial fate needed to begin to be decided upon before it could genuinely start from scratch.

In 2025, Velo3D is demonstrating that it’s doing just that, under the helm of Dr. Arun Jeldi, also the owner of Arrayed Additive. As I wrote about in a post from a couple of months ago, Velo3D made a number of synergistic moves in the first half of this year that give the company a rather impressive roadmap for rebuilding. Along with deals to buy powder from Amaero International and to develop applications for Ohio Ordnance Works, Velo3D has also expanded its exposure, from multiple angles, to the highly intriguing commercial satellite market, and sealed a four-year Cooperative Research and Development Agreement (CRADA) with two U.S. Naval Air Systems Command (NAVAIR) laboratories.

Perhaps the most crucial explanation accounting for this momentum shift lies in the company’s establishment of a new business model, hinging on a service called Rapid Production Solutions (RPS). Instead of just selling machines, Velo3D now focuses primarily on developing applications, which the company develops in collaboration with its customers. Once the applications have been developed, it’s up to the customers whether they want to produce the parts in-house, whether they want Velo3D or its affiliated contract manufacturers to make the parts, or if they simply want to take the designs and run with them on their own.

It’s a risky strategy to the extent that it bucks against the standard tech business model of focusing almost exclusively on locking customers into your ecosystem. At the same time, though, AM is just as much a part of the machine tools industry as it is a part of the tech sector, and the flexibility that Velo3D can offer customers may be exactly what the marketplace will demand as an environment of endless uncertainty sets in more permanently.

One reason that this new business model may prove to be not so difficult a transition for Velo3D is that it accentuates what has already, for years, been the brand’s greatest strengths. When I talked to four members of Velo3D recently, Chief Revenue Officer (CRO) Michelle Sidwell pointed out that, although RPS itself is a new offering, the underlying principles at work are nothing new for the company:

“We’ve always worked alongside our customers’ engineering teams to go after those complex parts and help accelerate the process of getting them into their production lines. We started out with space companies and then took those lessons that we learned and applied them across other areas of defense and aerospace, as well as to other similarly demanding sectors like semiconductor equipment and energy,” Sidwell explained. “So while those markets are areas that most OEMs have found it difficult to produce solutions for with their hardware, they’re actually the markets that are the best fit for our product line.

“RPS allows us to maximize our ability to take that know-how and help new customers lower their barriers to entry. Throughout 2024, we tested this concept out with primes and semiconductor companies and it proved to be a viable model. I also think it’s very appealing to DoD because they don’t need to buy machines in order to access the technology, which moves them through qualification and up to the production phase much more quickly than would be possible otherwise.”

One of the space companies that Velo3D has helped lower its metal AM barrier to entry, of course, is SpaceX, which has reportedly purchased more than 20 Velo3D printers over the years, using the technology to drastically streamline the Raptor 3 engine. Given how critical that component is to what’s currently the world’s most valuable private company, one could make the case that the Raptor 3 is the most significant end-use part that metal AM has ever delivered.

The Raptor 3 engine, image courtesy of SpaceX.

Among other factors, then, the ongoing explosion in public funding for space applications suggests that Velo3D is in an ideal position to land more government contracts in the years ahead. One of the company’s newest hires, Brice Cooper, serves as VP of Defense & Government Relations, and previously worked in defense procurement, in various capacities, for the U.S. government, including a role as the U.S. Army’s Senior Legislative Liaison to the House and Senate Appropriations Committees.

According to Cooper, the Department of Defense’s (DoD’s) rapidly evolving approach to procurement — characterized by prioritization of smaller, newer companies capable of quickly onboarding emerging technologies — means that RPS is a huge draw for the burgeoning generation of defense suppliers:

“From the primes to the first- and second-tier suppliers, and especially in the defense tech startup space, RPS is attractive because it offers a range of flexibility. If they’re not ready to make a capital equipment investment, they can start doing the prototyping, the early first article, and acceptance of parts and components all the way up to end-use items for munitions,” began Cooper. “Then, once they’ve already familiarized themselves with the technology’s capabilities, they can devise their plan regarding how it might make the most sense for them to vertically integrate our machines within their own facilities — or if they’re not ready, and just want to continue to rely on RPS.

“We’re doing this with the Air Force now: setting them up on initial first articles, and then once they’re satisfied, there’s already a production line waiting for them that can handle the job. That’s a particularly big selling point for projects that have the greatest urgency, so the branches don’t have to wait two or three years to test out a concept, then another couple years to find someone to award the project to.”

Matt Karesh, the company’s Director of Defense and Government Programs, added that one of the reasons this capability matters so much is that, for a new AM adopter, adopting the technology is never as simple as simply buying a machine:

”If you’re a prime, and you’re able to push the boundaries with your AM capabilities, that’s not solely a result of being able to afford more equipment. It’s also because you’ve got all these subject-matter experts, and an entire staff supporting them, that have expertise in using the technology at-hand.

“If you’re one of these smaller companies that’s just now entering the defense space, though, you’re almost certainly not going to have access to that same infrastructure — even if you can afford and know how to use the machine, you’re just not going to be able to take the same advantage of it.

“On the other hand, RPS gives a small newcomer like that access to our team, in addition to our technology. They can now push the boundaries on what the technology can do, and in turn, that allows us to push the boundaries on our product, as well. It’s a symbiotic relationship.”

Cross-sectioned rocket parts 3D printed with Velo3D show internal channels.

One customer who was impressed with the company was Dr. Jeldi, the company’s new CEO and owner, who first formed a relationship with Velo3D when he was looking for companies that could 3D print magnesium powder, one of Arrayed Additive’s key offerings:

”Arrayed Additive was focused on developing aluminum and magnesium for lightweighting defense and space industry parts,” Dr. Jeldi said. “All of the other OEMs that I approached were too hesitant to try working with magnesium, but eventually I found Velo3D, and their team was willing to give it a shot.”

Later that year, Dr. Jeldi learned that the company was open to being acquired:

“I decided to invest in Velo3D in part as a strategic move to complement my conventional manufacturing companies,” he continued. “I’m a firm believer that AM is almost always used most effectively in combination with legacy production techniques, if only in terms of the equipment required for post-processing.

“Now Velo3D and my other companies, including Lite Magnesium Products and Crown Magnesium, have strong synergies that complement the reshoring of manufacturing supply chains. We’ve also collaborated with other metal providers to secure long-term contracts, which helps lower the cost.

“I think one of the reasons that metal AM, up to this point, has had difficulty scaling, is because companies haven’t paid nearly enough attention to the fact that costs in manufacturing are always determined by the cost of raw materials. That’s why vertical integration is so important.

“And in our case, it allows us to expand our facilities in the Midwest in addition to California, another factor enabling us to reduce costs. We’re going to be much more valuable to our customers than we would be if we just stayed an OEM. We’re creating a whole ecosystem, from feedstock to end product.”

The biggest shift that the company has undergone, in its transition from Buller, its founder and first CEO, to Jeldi, is its obsession with stripping everything down to the most fundamental elements of what it means to run a business. At the same time, though, to reiterate, the new approach also gives Velo3D its best opportunity to not throw the baby out with the bathwater, to capitalize on everything that the company learned under Buller’s leadership:

”It’s always challenging to transition from the founders because they have their whole heart in it, and so much passion,” Sidwell noted. “Benny is an incredibly smart person who created an incredible product and hired amazingly smart people. From a business perspective, we needed to shift our stance in order to align with our customer needs, and to focus on product-market fit. Those were the most important changes that needed to take place, and I think Arun’s approach to business was the missing piece.

“We needed that traditional business acumen in order to scale. Arun has also infused the company from the top-down with one cohesive focus, and I think Velo3D across the board works more as a unit, now. We’ve aligned everything we do from the sales perspective all the way through the most technical aspects.”

As Karesh put it,

“I don’t want it to get lost that Velo3D wouldn’t exist without Benny. The reason it progressed to the point where it did before he left was because of his drive and his passion, like Michelle said.

“But he also got it to a point where it grew into an entity that needed a different skill-set at the helm. We had a team that was really good at innovating, but we grew into a company that needed to be really good at what you might think of as the boring stuff.

“That doesn’t mean we’re going to stop innovating, it just means that we’re putting the processes and procedures in place that will allow us to keep maturing as a company that can mass produce, in a repeatable way, where quality control is always the top priority.”

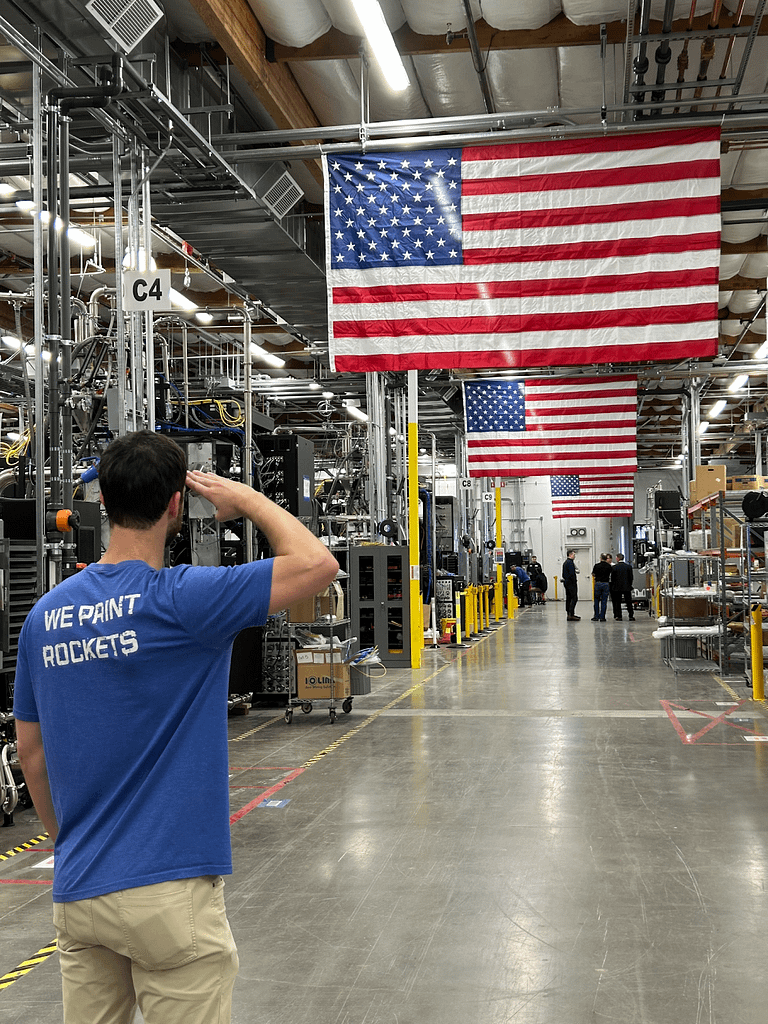

Finally, another selling point that the company was already laser-focused on under Buller was reshoring, with Velo3D prioritizing making its machines in the U.S., and making DoD-compliant cybersecurity a key advantage of its ecosystem. This could be Buller’s most critical contribution of all to the company’s corporate ethos.

In a context in which the entire AM industry is scrambling to figure out how to benefit from trade war conditions, Velo3D may be the company that has already put itself in the best position to do so. Building its entire ecosystem with that in mind is a genuinely differentiating factor for the brand, and is all the more important for precisely the sort of strategic sectors that Velo3D — and the rest of the metal AM world — are most interested in.

What sets Velo3D apart from its competitors, in this aspect, is, from Cooper’s perspective, essentially a talk the talk vs. walk the walk situation:

“This is across all critical emerging technologies, but it’s very applicable to Velo3D, and the space that we’re in, specifically,” the retired Green Beret prefaced. “If you’re not in the position in the next 12 to 24 months to go after the 150 billion dollars in reconciliation, which means you need a technology that’s available now for the DoD, and for the U.S. industrial base, you’re going to miss out on a generation opportunity to capture revenue.

“That’s what was most interesting to me once I got to know the company, as I was onboarding and I realized what the opportunity was. I think that, over the next two years, companies that check the boxes that DoD is looking for are going to be in a really unique place to solidify what the next 10 to 15 years of national security policy will look like, because that’s the importance that industrial policy is taking on in the emerging world order.

“Velo3D is uniquely suited to meet that challenge. A lot of our competitors are obviously trying to scale in that same direction, as well, right now. I just don’t know if they’ll be there in time.”

Unless otherwise noted, images courtesy of Velo3D