AI is already a pillar of global manufacturing strategy, even as its practical limitations signal that manufacturers will require quite some time to iron out the fundamental wrinkles involved. But the additive manufacturing (AM) industry has figured out at least one major use case for AI that users have incorporated into the workflow for years: nesting.

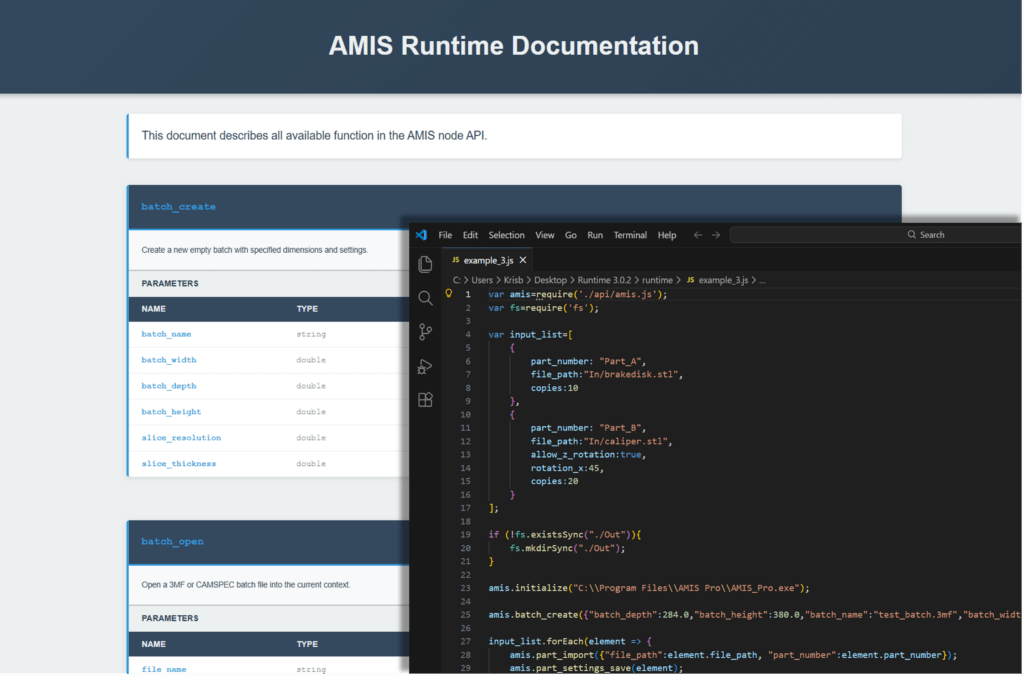

AI-optimized nesting has been the cornerstone of the Belgian company AMIS’ entry into the AM market, with its AMIS Pro software enabling subscribers to automate the build preparation phase so that it results in maximum throughput while minimizing the amount of human labor required. AMIS, part of the HYBRID Software Group, is now announcing the release of AMIS Runtime, which the company claims is the first platform to support “fully autonomous, continuously re-nested build preparation.”

This means that, if a build isn’t printing yet, the nesting design can be rearranged to account for new orders or shifted objectives, and this function operates without any need for manual human intervention. AMIS Runtime also automates other steps in the build preparation phase, including part import, slicing, and exporting, providing the digital backbone for truly automated, industrial-scale AM users.

AMIS Runtime allows users to automate build prep across SLS, MJF, binder jetting, and material jetting processes. Prior to the public release, AMIS tested Runtime with users “at two industrial production sites,” which gave the company the ability to incorporate real-world user feedback into the software’s final version.

In a press release about AMIS’ release of AMIS Runtime, the company’s Managing Director, Kris Binon, said, “Build preparation drives both quality and economics in [AM]. By automating this step, AMIS Runtime helps users achieve better density, fewer errors, and smoother workflows — and that translates directly into lower cost per part and more predictable production. Early adopters already see the difference in day-to-day operations.”

If 2026 is indeed “The Year of the Low Cost Print Farm,” then higher-cost service bureaus will be under pressure to find ways to stay relevant. One way that the market will presumably sort out the situation already seems to be happening: the largest part orders comprised of the lowest-value components will continue to drift to print farms powered by cheap desktop printers, while more expensive, more experienced service bureaus will live off of higher-value, lower-quantity jobs for industries with the most stringent regulations.

Solutions like AMIS Runtime should come into play as competition intensifies between the service bureaus dependent on orders with relatively high costs per part. Ultimately, if there’s little to differentiate between one service bureau and another in terms of part quality, there won’t be many factors other than cost that drive customer choice amongst AM service providers.

That’s when the real ROI advantage achievable with automation will start to announce itself to the AM industry, and software providers like AMIS should be the primary beneficiaries. This doesn’t mean that picking winners and losers will be as easy as observing who is subscribing to AMIS Runtime and who isn’t, but it does suggest that players in the service bureau market could ultimately sink or swim based on the soundness of the long-term automation strategies they’re currently developing.

From a broader perspective, the fact that AM already has a tangible AI use case solution it can point to that’s been a routine part of industry workflow for years puts it in an advantageous position compared to legacy manufacturing processes, and helps make the argument that reshoring should happen primarily in the form of an acceleration of manufacturing’s digitalization. When human labor power is the greatest limiting factor for a potential manufacturing resurgence, the companies that succeed will be the ones who can yield the greatest increase in productivity with the smallest addition of new human workers.

Images courtesy of AMIS