At MMX 2025, Ben DiMarco, Technology Transition Director at America Makes, posed a question that resonated deeply across a room filled with additive manufacturing (AM) experts: “How can we trust these numbers?”

Market estimates from respected firms often differ. This is not because one is “right” and another is “wrong,” but because market intelligence today reflects a more complex, segmented, and rapidly evolving industry. Understanding why numbers differ has become just as important as knowing what the numbers are.

The new reality: advanced customers, advanced needs

When I stepped into a leadership role at Wohlers Associates, I was tasked with guiding the next phase of market intelligence. From day one, I asked a fundamental question: What do our customers truly need from market intelligence today?

To answer it, we listened extensively. Through voice-of-customer research at events such as the 2024 and 2025 editions of the ASTM International Conference on Advanced Manufacturing (ICAM) and Formnext, as well as surveys of current and former clients, a clear theme emerged: the AM industry has moved beyond the need for introductory or purely descriptive reports. Today’s leaders demand timely, decision-ready intelligence that can stand up to strategic, financial, and board-level scrutiny.

As the industry matures, the negative consequences of misinterpreting market data grow. Capital allocation, product roadmaps, M&A decisions, and geographic expansion strategies increasingly depend on how market numbers are understood, and not just what those numbers are.

This shift has reshaped how we think about our role. At Wohlers Associates, we believe our responsibility goes beyond publishing a report. Our job is to empower customers to ask the right questions and to interpret market intelligence with confidence, regardless of the source.

Why market numbers differ and why that matters

For decades, static market reports served the AM industry well. But as the industry has grown more global and diverse, the assumptions behind single-number answers have become harder to see and more important to understand.

Based on our experience and the most common questions we hear from users, there are four considerations every executive, investor, and decision-maker should evaluate before trusting or purchasing market intelligence.

Four questions every market intelligence user should ask

1. Sample size: Is the data truly representative?

No credible market study captures 100% of an industry. However, extremely low response rates can significantly limit the confidence with which results can be generalized unless they are clearly disclosed, contextualized, and supported by additional data sources.

Understanding the size and distribution of the underlying sample allows users to judge whether insights reflect broad industry realities or a narrow subset of participants.

2. Selection bias: Who is actually represented?

Even a strong response rate can mask meaningful bias if participation is dominated by a particular region, company type, or segment, such as machine OEMs or respondents from a single geography, for example.

Professional market intelligence should disclose sample composition and apply appropriate weighting to account for these imbalances. Without this transparency, the numbers risk reflecting who responded most enthusiastically, rather than how the industry as a whole is evolving.

3. Size effect bias: Are companies weighted appropriately?

As the industry matures, interpreting growth requires distinguishing between signals from fast-growing, emerging companies and the performance of large, established players operating at vastly different revenue scales.

Rapid percentage growth among small firms can be strategically important, but it should not overwhelm the broader market picture if large enterprises represent most of the industry’s revenue. Reliable intelligence accounts for this through thoughtful weighting and segmentation, rather than simple averaging.

4. Definitions and scope: Are you comparing apples to apples?

Not all market estimates measure the same “market.” Definitions can vary widely, including whether desktop systems are included, how industrial equipment is categorized, and where price thresholds are set.

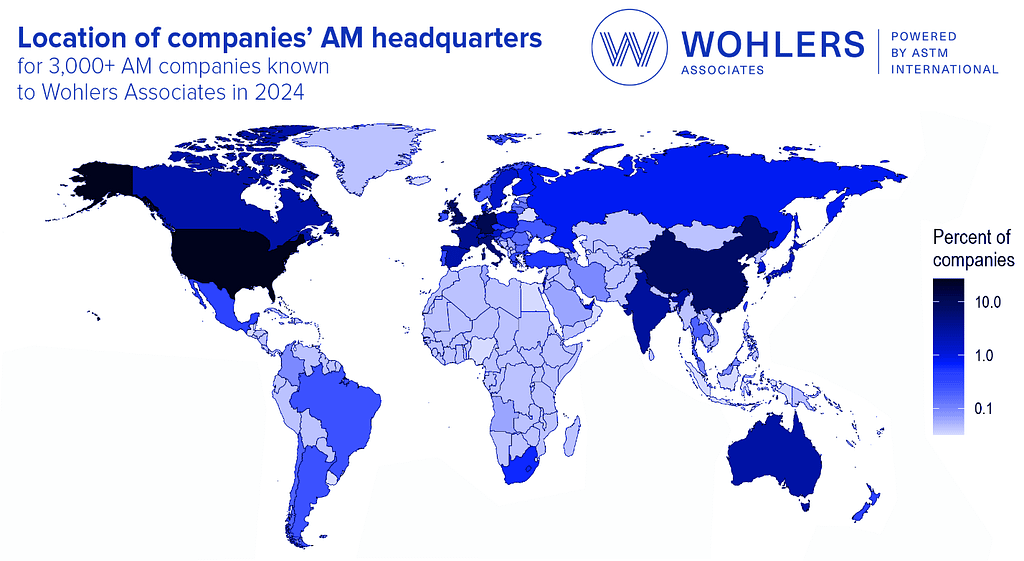

Given the sheer speed with which the AM industry advances, fixed definitions and single-number answers increasingly fail to reflect how real decisions are made. Without clarity on what is included and excluded, comparisons across reports can be misleading, even when each analysis is internally sound.

Transparency is a shared responsibility

Mr. DiMarco’s question, “How can we trust these numbers?”, was not aimed at any one provider. It reflected a broader shift in expectations across the AM ecosystem.

The industry deserves market intelligence that is rigorous, transparent, and designed for real-world decision making. Providers have an obligation to clearly communicate assumptions, methodologies, and scope. Users, in turn, have the right and even responsibility to ask the questions that ensure numbers are being applied appropriately to their specific use cases.

Trust is not built by eliminating differences in market estimates. It is built by making those differences understandable.

Transformation at Wohlers Associates

Wohlers Associates is advancing alongside the AM industry itself. While The Wohlers Report remains our flagship publication, we are expanding beyond the traditional static report model to build a next-generation market intelligence ecosystem, one designed to make assumptions visible, definitions adjustable, and insights defensible.

The future of Wohlers Associates includes:

- An Advanced Market Intelligence Platform: A dynamic, interactive portal that allows AM decision-makers and analysts to explore data by segment, geography, company size, and definition, tailored to how decisions are actually made. The market intelligence platform is currently in beta testing with a select group of companies.

- Custom Data Analysis: Bespoke market sizing, segmentation, and forecasting aligned to the specific strategic questions of users, even when those answers don’t exist in a standard report.

- Targeted Advisory Services: Deep-dive support that connects market intelligence directly to business strategy, investment decisions, and execution.

The full platform and Wohlers Report 2026 will launch in Q1 2026. Sign up for early access.

We look forward to continuing this evolution in close partnership with our customers, because the most valuable market intelligence is built not just on data, but on trust, transparency, and dialogue.

Want to learn more? Contact us at wa@wohlersassociates.com and be sure to see Mahdi Jamshid, Director of Market Intelligence at Wohlers Associates, powered by ASTM International, participate in “Panel: 3DP/AM Market Data and Outlook” at Additive Manufacturing Strategies in New York. Register here.

About the Author

Mahdi Jamshid, PhD, is Director of Market Intelligence at Wohlers Associates, powered by ASTM International. He leads research and analysis on additive manufacturing markets, technologies, and industry trends, supporting data-driven insights for organizations across the AM ecosystem.