Remember Villeneuve’s Dune? The pursuit of rare and powerful spice (“venture alpha“) brought heroes into deserts hiding sandworms and shifting dangers (for those unfamiliar, think of a high-stakes quest through a dangerous desert). Additive manufacturing (AM) in 2025 feels similar: a field with vast promise, yet buried under unstable terrain and a lack of data. And just like on the desert planet in Dune known as Arrakis, chasing unicorns without visibility often ends in disaster, the kind that comes from a sudden encounter with sandworms.

The quality of data is bad, and it’s always outdated

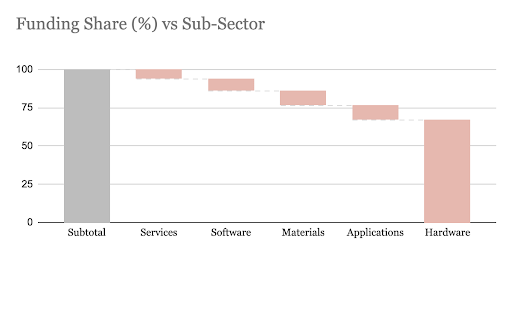

Startup funding data — from platforms like Crunchbase, PitchBook, and others — is often inaccurate in general, and this is even more so in 3D printing. Most data sources rely on news and announcements for their information. And it is usually announced late, only to raise the next round of funding. Moreover, industry reports are typically annual and behind a paywall, usually priced beyond the reach of small funds and entrepreneurs. Meanwhile, China, which is home to the second-highest number of 3D printing startups, is behind a (3D printed) wall just like its internet.

What’s So Unique About Our 3D Printing/AM “Arrakis”?

It is a hardware-first industry, so it leads to many problems with delays, data reporting, and mapping:

- It’s very different for AI, where we can benchmark the new OpenAI’s o3-pro model the same day it was released. Hardware takes time to design, produce, and wait for the practical results. There’s no CAC (customer acquisition cost), no LTV (lifetime value), no NRR (net revenue retention) — the software-style growth metrics investors know well — just custom machinery, proprietary materials, and closely guarded PDFs.

- The next problem is the supply chain. It is fragmented across industries and geographies, with no unified benchmarks in place.

- Founders also hide their IP as the core moat. It also leads to a lack of reliable data.

- Finally, very few companies in this space have reached real scale and market adoption, making meaningful benchmarking nearly impossible.

Past Hype Scorched Investor Trust in 3D Printing

Past Hype Scorched Investor Trust in 3D Printing

The 3D printing hype cycles of the past decade offer clear warnings for investors:

- Desktop Metal, once valued at $2.5 billion via a SPAC, missed aggressive revenue targets and faced mounting losses. A proposed merger with Stratasys in 2023 after burning through capital was ultimately called off after investor pushback.

- Markforged followed a similar path — public via SPAC (special purpose acquisition company) deals, then crashed over 90% as adoption lagged promises.

- Public pioneers like 3D Systems and Stratasys saw massive stock declines post-2014 after overpaying for acquisitions and failing to retain customers.

- Cathie Wood‘s ARKQ fund (ARK Autonomous Technology & Robotics ETF), along with the 3D Printing ETF, saw sharp declines as overly optimistic forecasts failed to materialize.

Most of this collapse was caused by poor visibility into customer traction, margins, and scalability — symptoms of a data desert.

Why it’s a huge opportunity

Yet despite the scorched trust, we still need additive manufacturing’s spice — because AM is quietly becoming the foundation of future production. In a world drifting toward deglobalization, 3D printing offers fast, local, tool-free manufacturing. U.S. policy is shifting too: the Department of Defense (DoD), the Defense Advanced Research Projects Agency (DARPA), and NASA now fund AM for housing, defense, and space infrastructure.

Combined with AI, the sector is moving from prototyping to deployment. We may be at the early majority phase — still overlooked, but strategically vital. I project that the industry will double or triple in the next two to three years, not due to hype, but out of necessity.

How AI Can Bridge the Data Gap

The lack of structured data in AM isn’t just a problem — it’s a product opportunity. AI is already making startup ecosystems searchable: RAG (Retrieval-Augmented Generation) pipelines, semantic indexing introduced by startup databases like Specter, Crunchbase, and AlphaSemantic, and other innovations are beginning to change how we track private markets.

And finally, as more 3D printing companies mature and go public, demand for structured insights will rise, and we will have more data points to analyze.

About the Author: Cyril Shtabtsovsky is an entrepreneur and venture capitalist focused on frontier technologies, including additive manufacturing, AI, and advanced materials. He is the founder of AlphaSemantic, a startup using AI to make venture capital more data-driven. Cyril currently advises Aloniq, an early-stage VC firm, and mentors startups through Alchemist Accelerator. He has served as a judge for the Venture Capital Investment Competition and leads the Armenian chapter of Founders Running Club, a global community of over 20,000 entrepreneurs.

All images and graphs courtesy of Cyril Shtabtsovsky.