Last year, on stage at AM Strategies, the argument was simple: additive manufacturing had to stop chasing elegance and start chasing economics. The 3D printing community had spent decades refining precision, control, and aesthetics — but too often left cost out of the equation. AM’s competition is legacy manufacturing methods, not other forms of AM. The reality is that until AM can compete with casting and forging on a dollars‑per‑kilogram basis, it will remain a specialty tool rather than a true production solution.

In the same year, we saw a $20K metal printer at Formnext. The landscape looks very different. The conversation is no longer hypothetical. Credible PBF machines exist for less than $50,000. The good news is, for AM to succeed, it is less about the printer and more about the parts.

In my discussion this year, aside from the original song lyrics and occasional dad jokes, I want to think about the implications of a $50k printer. When machine prices drop from high six or seven figures into the tens of thousands, the economics shift from capital projects to accessible production assets. Suddenly, hundreds of small and midsized manufacturers, job shops, and tier‑two and tier‑three suppliers can afford to enter metal AM in a meaningful way.

But this new reality comes with an uncomfortable question: are we ready? What happens in a tight powder supply and demand market when printers become affordable? Every $50K printer that lands on a shop floor is a long‑term commitment to powder consumption. As fleets grow, the demand for metal powder doesn’t just increase linearly; it accelerates across alloys, lot sizes, and geographies. Instead of a handful of aerospace alloys in a few regions, the industry will see a long tail of materials tuned for diverse applications, each demanding consistent, reliable & repeatable supply.

Today’s global metal powder market is already substantial, and the vast majority of volume is produced via atomization. Most of it is water atomized. Gas and plasma atomized powders, which typically feed high‑end metal AM, make up only a small slice of total output. Yet, that narrow base is expected to support any explosive growth triggered by lower‑cost printers. Scaling that legacy infrastructure is not a matter of tweaking a few process parameters. It requires large furnaces, complex gas systems, high‑integrity safety installations, long permitting timelines, and billions of dollars in capital.

Even if the money is available, the workforce may not be. Traditional atomization plants depend on specialized metallurgical, process, and maintenance talent, the same skills already in short supply across heavy industry. Adding multiple new large‑scale atomization lines worldwide is not just a capital project; it is a human‑capital project in a labor market that is signaling constraint, not surplus. The paradox is stark: just as metal AM becomes more democratic at the machine level, it risks becoming more fragile at the materials level.

This fragility becomes the governor on growth. The current model is not sustainable. From this user mindset, I knew we needed to find alternative ways to produce powder that could scale to meet growing demand. That’s how my other company, Metal Powder Works, came to be.

Let’s face it, the inefficiency and inconsistency that come with atomization aren’t going to propel AM to compete with castings. This is where understanding the true requirements in AM for powder matter comes into play.

At Metal Powder Works, for example, we’ve developed a process that directly produces highly consistent powders with high yields and low CAPEX and labor. Fewer people running highly efficient machines with higher sellable output. The result is a cost of capital that’s a fraction of conventional systems, combined with automation that requires only a small, specialized workforce. It’s a model built for scalability, not for a few specialized plants, but for distributed, demand-driven production hubs worldwide.

This kind of approach doesn’t just solve a supply problem. It unleashes innovation. When powder becomes more accessible and more affordable, new alloys enter the picture. Designers can specify materials for performance, not just availability. The ripple effects touch every part of the AM ecosystem, from machine OEMs to software to quality certification.

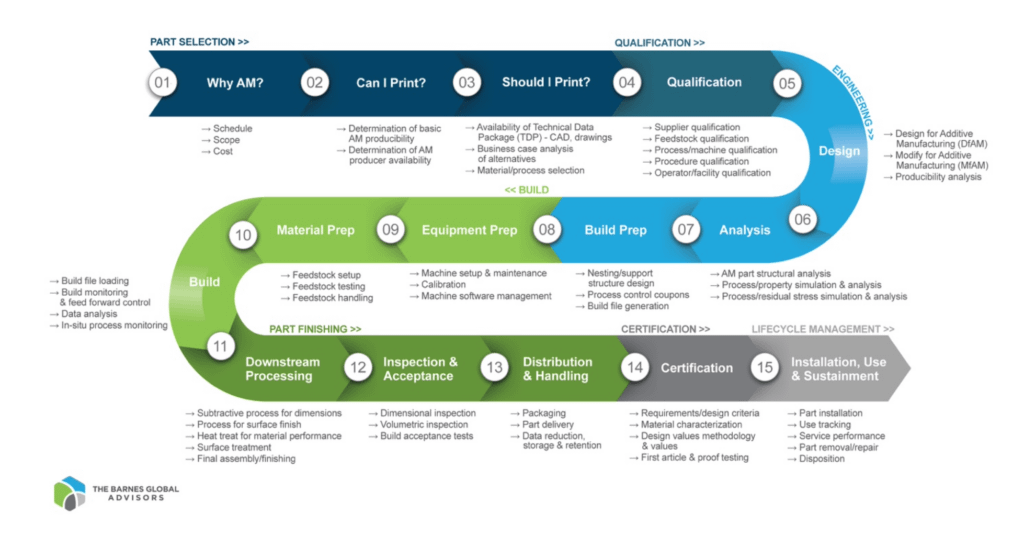

As I like to say, ‘we were always going to be here,’ and AM is a system of systems. We stand at the threshold of abundant, affordable PBF printers. The real work begins now. AM is a team sport. It requires abundant, diverse, consistent powder. Printers to create them into a shape. Heat treatment, machining, and inspection to make and validate the part.

The thesis for this year’s keynote is straightforward: the $50K metal printer is not the end of the story; it is the beginning of a new chapter. If AM truly intends to displace casting and forgings on a dollars‑per‑kilogram basis, we must understand the entire value chain for making a part. Within that, the next wave of innovation must flow into what are truly the requirements for metal powders in AM, not just how they are melted. The winners in this era will be the companies and investors who realize that in the production age of additive manufacturing, controlling the powder means controlling the future.

John Barnes is the Founder of The Barnes Global Advisors (TBGA) and CEO of Metal Powder Works.

Barnes has a 25+ year career in product development and aerospace with Honeywell, Lockheed Martin Skunk Works, Australia’s CSIRO, and Arconic (formerly Alcoa and RTI International Metals). He’s been involved in metal additive manufacturing throughout this career beginning in the late 1990s where he was part of the Sandia National Labs LENS

The Barnes Global Advisors is the Presenting Sponsor for Additive Manufacturing Strategies (AMS), a three-day industry event taking place February 24–26 in New York City. Andy Davis, Director of Government Solutions, will moderate a panel about “Advancing AM for Defense” on February 24th, and Barnes will present “20(/)30 Vision: Adoption” on February 25th. Registration is open via the AMS website.