Defense spending around the world has been skyrocketing in the last few years, with the 9.4 percent growth in 2024 constituting “the steepest year-on-year [YOY] rise since at least the end of the Cold War”. On an interrelated albeit much smaller scale, public spending on additive manufacturing (AM) for the military has increased in parallel, especially by the U.S. Department of Defense (DoD): the most recent AM Research report on the topic estimated that the DoD spent $800 million directly on AM in 2024, a YOY increase of 166 percent.

Here’s how quickly this market segment is transforming: a couple of years ago, I used to be able to cover more or less everything the DoD was doing with AM. By last year, that had become a real struggle; in 2025, it’s essentially impossible. The best I can do is try to identify the main threads and keep track of how they unfold from month to month.

Thankfully, the platform I’m privileged enough to have access to compels AM professionals working on defense applications to reach out and share their experiences with me, which helps considerably in cutting through all the noise. Most helpful of all is when those individuals have experience that is broad and deep enough to give them institutional memory of the DoD’s trajectory throughout its progress with AM.

Mike Shepard, the VP of Aerospace and Defense at 3D Systems, is one of those rare individuals: he’s not only been working in the AM defense market segment far longer than this most recent boom; in fact, prior to his work in the private sector, Shepard worked for sixteen years at the Air Force Research Laboratory (AFRL), one of the world’s most influential AM scalers. At this point, having spent over a decade each in the government and commercial AM defense markets, there aren’t many people with a better vantage point for assessing the current state of military 3D printing.

Similarly, 3D Systems has been working with the DoD for years, receiving contracts for major jobs from each of the major branches, long before everyone else in the AM industry started paying attention to the U.S. military. For instance, the Navy and what’s now being referred to as the Maritime Industrial Base (MIB) have lately become centerpieces of the discourse on DoD advanced manufacturing activity. Meanwhile, as far back as 2015, 3D Systems had already partnered with two different U.S. Navy research labs, helping lay the groundwork for the rapid advancements the maritime branch is making today.

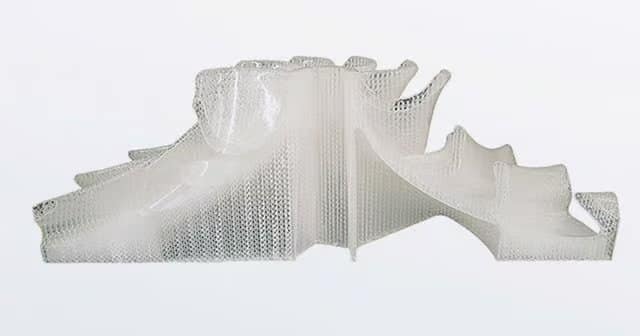

Hollow casting patterns for aerospace components, made with 3D Systems’ SLA technology.

As it happens, maritime applications remain one of the defense application areas that Shepard finds most promising:

”There are quite a few components on U.S. naval vessels right now that have been made on our machines,” Shepard told me. “Some of our first work was part of a joint development agreement with Huntington Ingalls Industries (HII) Newport News Shipbuilding, one of two shipyards in the U.S. that makes submarines, and the only shipyard that makes aircraft carriers.

“Having a partner like that, who can truly help you understand all of the history and ancillary engineering that’s contributed to the development of the application space, has been indispensable to our work for naval applications. And now, because of the supply chain issues that the U.S. Navy is facing, the branch has taken to metal AM with great enthusiasm.”

What really gives 3D Systems an edge in this context is its extensive materials development expertise, which is coming in handy in an era when products from supply chains dependent on traditional manufacturing methods are no longer so easy to come by. In 2022, 3D Systems was the first-to-market in the AM industry with its copper-nickel alloy (CuNi30), a material fundamental to shipbuilding in large part because of its resistance to saltwater corrosion:

“We co-developed CuNi30 with HII. While it’s a very common casting alloy, it’s also an extremely challenging alloy to cast,” Shepard explained. “The yields on those castings are very, very low, and there aren’t too many operations out there these days who are still doing copper-nickel castings.

“At the same time, the maintenance, refit, and overhaul (MRO) enterprise for the Navy is pretty intense — they need to get those ships buttoned up and back out to sea as quickly as possible. They’re at a point where some of the castings have lead times of two years, sometimes more, and on top of that, they’ll get a lot of the parts back after those brutal waits, and when they X-ray the parts during inspection, they’re Swiss cheese.

“PBF with CuNi30 has been a revelation for them. The mechanical properties are as good or better than anything they’ve ever had from casted parts, and the density is dramatically improved.”

While the Navy has Shepard especially energized these days, the underlying principles at play translate across the DoD as a whole. That’s an angle that was at the top of my list to get Shepard’s take on: how the same dynamics that are driving military AM efforts show up again and again from one branch to the next, and even more broadly, how those same dynamics might inform the work being done for all the other verticals the AM industry is penetrating.

Lightweight brackets for satellites made with 3D Systems’ Direct Metal Printing (DMP) technology.

First off, Shepard broke things down into three different categories: (1) tooling, (2) replacing obsolete parts, and (3) creating wholly new, AM-optimized designs. For instance, the work with the Navy that Shepard described falls into the second category:

“The first thing people tend to want to do is address the issue that’s causing the most pain. So, before anyone really knew what they were doing when it came to AM, they’d start with something mission critical,” said Shepard. “But you quickly find out, that’s an incredibly unhelpful move. You can’t run before you crawl and walk.

“Don’t try to do the hardest thing first. Instead, you have to try to find jobs that are going to help you really learn the new manufacturing processes, and learn every important lesson you have to learn when you’re first getting started, but with a low level of risk. That’s more or less the reason why DoD pivoted to starting with jigs and fixtures. After jigs and fixtures, the next thread is, can we make old parts in a new way?

“Those are the dynamics at work with the Navy’s replacement of castings, because the fleets have to last between 30 and 50 years, but the dynamics are similar for aerospace, and even for a lot of the Army’s ground vehicle systems.”

Design optimized propulsion system component made with DMP. Image courtesy of 3D Systems.

According to Shepard, the way progress tends to happen within a DoD ecosystem is through the “crawl” and “walk” phases, where tooling and obsolete parts occur simultaneously. After a lot of effort devoted to cultivating that initial crawl and walk feedback loop, AM adopters can finally “run”, i.e., optimize parts in completely new ways only possible thanks to the design freedom that they’ve unlocked:

“The crawl and walk phases work in parallel, in my experience, because it takes so long to do the preliminary analysis and engineering work on the first applications involving making old parts in a new way,” Shepard elaborated. “So you can make progress on the tooling front, getting better and better at making jigs and fixtures, for instance, while you’re working your way up to reproducing obsolete or low-production parts with AM.

“Once you’ve successfully produced those first obsolete parts, that’s when you can start to run — you can move on to start making truly new components. That’s the most powerful use of AM, when you get to start from scratch on the drawing board. You can take advantage of all the special capabilities for weight reduction, parts consolidation, integrated cooling.

“But that’s more or less the evolution: you start from the point of lowest risk, work your way up to addressing supply chain grief, and then finally, you create new systems that really improve the functionality of the end-product. DoD is really good at this process because it has such a long, thorough history of adopting new manufacturing technologies, but ultimately I think the principles apply to any organization that’s setting out to incorporate AM into its workflow.”

Finally, companies like 3D Systems have a track record. However, much recent AM industry attention has been consumed by how upstarts producing low-cost machines have dug into the market share of established players, at least regarding certain processes like FFF and FDM.

One point that I think has gone overlooked in that conversation is cybersecurity. Is it possible that, as the military ramps up its AM adoption, the demand pendulum might start to swing back in the direction of the higher-grade industrial machines, precisely because they’re more trustworthy?

“I can’t overstate how important cybersecurity is,” affirmed Shepard, “particularly when you want to be active in the defense space. The more you dig into what the requirements are for a company working with DoD, the more you realize how many policies and procedures you need to have in place in order to meet the necessary standards.

“We’ve rolled up our sleeves and done that. Making sure that you have secure places to store data that has any type of control on it, or export compliance profile on it — you need to lay in all of that infrastructure. There’s training that employees need to have, there are software and machine architecture ramifications.

“From our side, one thing we’ve built into the equation from the bottom up is that all of our systems can be air gapped. There are obviously conveniences associated with being on a network, or connected to the internet, but you never need to do that, and when you’re working with defense, you generally need to not do that. Connectivity is very powerful, but also adds a lot of risk.

“So I would contrast that against all these consumer-grade machines that have gotten really sophisticated technologically, but where is the data going? There are companies out there that have made good machines at really attractive price points, but I think that, under the surface, everyone pretty much knows what’s going on there with the data.”

Featured image is the 3D Systems DMP Factory 500. All images courtesy of 3D Systems.